The Affordability Challenge in the GTA Housing Market: Beyond Interest Rate Discussions

Lower interest rates, often seen as a means to stimulate economic growth, have significant implications for housing prices. As borrowing becomes cheaper, demand for housing increases, driving up prices and exacerbating the existing imbalance in the market. This trend places even greater pressure on affordability, particularly for first-time buyers and those in lower-income brackets, further contributing to the current market crisis.

Policy Options: Fixing the Mismatch in Canada’s Housing Supply

This is the moment to address the mismatch in Canada’s housing supply. Policy Options: Fixing the Mismatch in Canada’s Housing Supply

However, maintaining high interest rates is not a viable long-term solution. According to a recent Financial Times report, “Inflation fell to the central bank’s two percent target in August, and Governor Tiff Macklem noted that economic growth will need to pick up to prevent inflation from falling further below that level.” While a rate cut may be necessary to support overall economic growth, its impact on the affordability gap remains uncertain.

Despite the Canadian economy growing by 0.2% in July, it fell short of the Bank of Canada’s forecasts. Financial Post: Canadian Economy Growth

In this environment, policy decisions regarding interest rates must be carefully balanced to address both the need for economic stability and the persistent challenges in housing affordability. The focus should not only be on short-term market movements but also on long-term solutions that ensure the housing market serves the broader needs of society, rather than just those with the greatest access to capital.

Key Insight: Affordability Crisis and Investor Influence

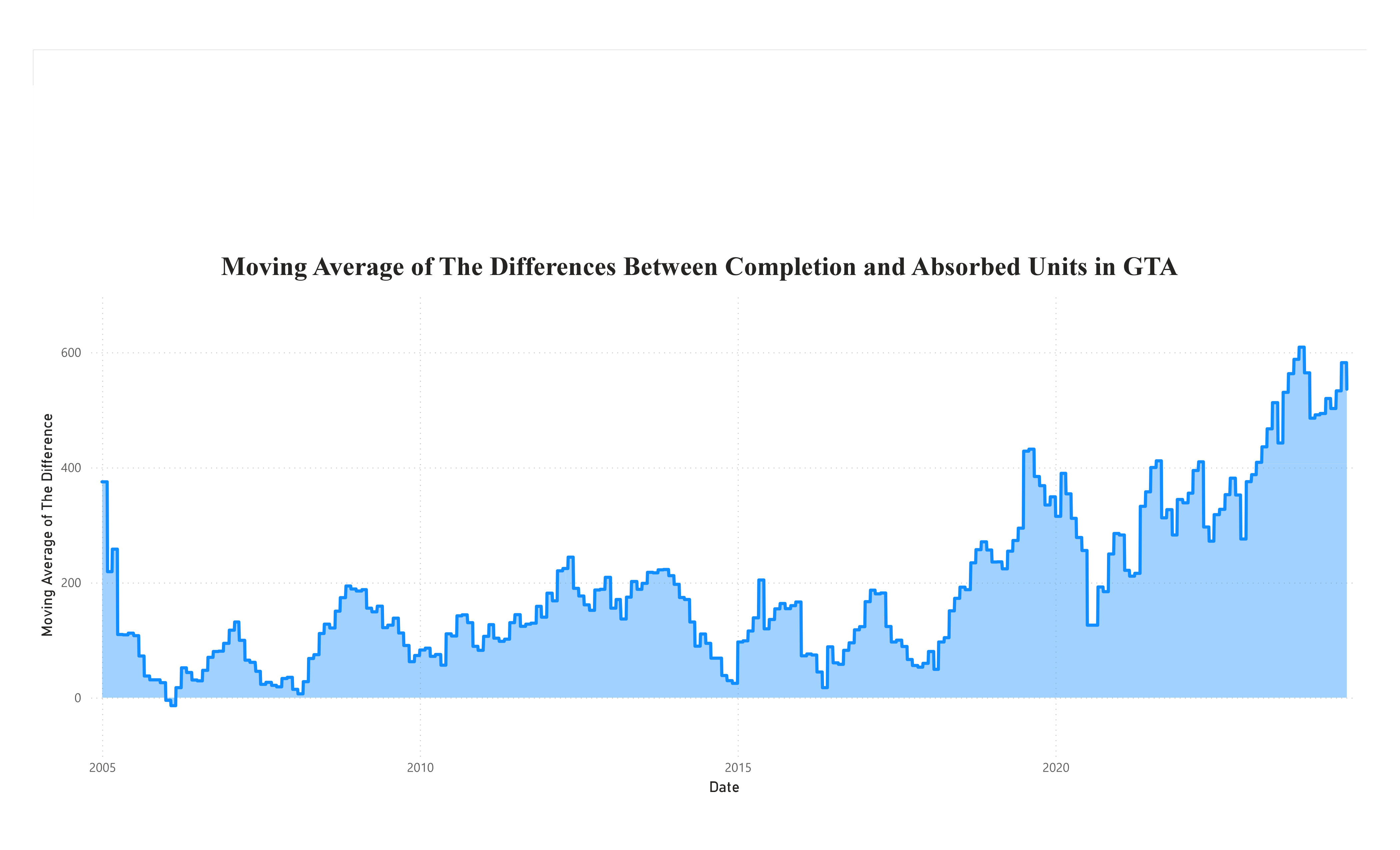

The affordability crisis is not merely a matter of supply and demand; it’s also driven by investors seeking high returns, while middle-class buyers find themselves priced out of the market. Despite an increase in housing completions, absorption rates have slowed dramatically in key regions, creating a surplus of unaffordable units while demand for affordable homes continues to soar.

Figure 1: Moving Average of the Differences Between Completed and Absorbed Units in the GTA from 2005 to 2024

Caught between policies that promote investment and efforts to tighten liquidity to safeguard the economy, those with fewer resources are struggling. They face rising costs and a declining quality of life, unable to compete in a system that often prioritizes aggregate wealth over the basic well-being of individuals.

Future Projections and the Role of Interest Rates

In the coming days, the release of employment data will play a crucial role in shaping the Bank of Canada’s decision regarding the size of its upcoming interest rate cut. While a rate cut is expected, Katherine Judge, an economist at the Canadian Imperial Bank of Commerce, notes that weak employment figures could prompt a more aggressive move, potentially leading to a 50-basis-point reduction instead of the anticipated 25 points, as the central bank seeks to stimulate the economy and align growth with inflation targets.

Despite the prolonged struggle between affordability and profit margins, the anticipated reappearance of lower interest rates is poised to spread renewed optimism across the market.